ETF-JDR makes it easier to bring Foreign ETF into Japanese market and circulate it smoothly.

ETF-JDR is tradable same as Japanese domestic stock.

- JDRs (Japanese Depositary Receipts) are negotiable securities which indicate ownership of shares issued by foreign companies. They are listed and traded on Japanese Stock Exchange.

- JDRs make it easier to distribute foreign stocks, ETFs and ETNs within Japan.

- Foreign ETFs are tradable on stock exchange in Japan, when listed as ETF-JDR after trust bank issues JDRs backed by ETFs listed on the Foreign Stock Exchange.

Issuing JDRs can increase corporate and brand visibility at an international level.

JDRs are traded on stock exchange in Japan in accordance with Japanese market customs, which will expand investor's opportunities.

- Tradable on almost all the securities houses in Japan (also margin trading is available on many of them)

- Specified Account available

- Settlement distribution in JPY

- Same taxation as that of Japanese equities in Japan

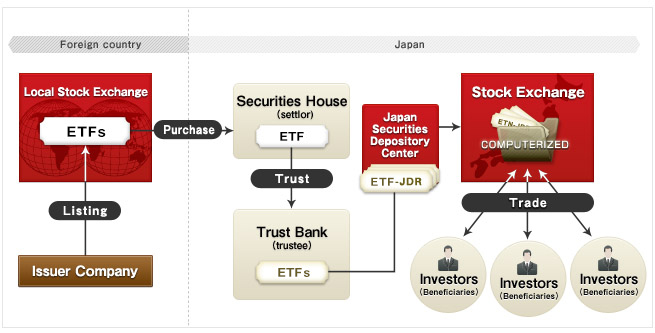

[Outline of JDR scheme]

- A securities house purchases the ETFs of Issuer Company through the local stock exchange

- The securities house entrusts a trust bank with the ETFs and the trust bank issues JDRs to the securities houses (using the book-entry transfer system of JASDEC)

- ETF-JDRs will be traded on the Japanese Stock exchange.

*Above is a model scheme of an ETF-JDR and may differ by products.

Our JDR Services

- Scheme Structuring

- Asset Administration

- JDR issuance

- Calculation and payment of JDR distribution etc.

Why MUTB?

- Since 2006, we have investigated the listing of JDRs.

- In July 2010, we launched Japan Physical Precious Metal ETF("Fruit of Gold" series), listed on the TSE using similar scheme to JDR.

- In July 2011, we have began providing ETN-JDR Services, First in Japan.

- In February 2012, we have began providing ETF-JDR Services, First in Japan.